Case Studies

- Home

- Case Studies

Last minute underinsured groundworker on cover

A family-run, growing, ground working & civil engineering business working across Greater London and England.

Large scaffolding contractor’s complex work expansion solved

A large scaffolding contractor based in the South East required a proactive solution to their claims record/growth, and work on spectator stands…

Scaffolding contractor faced 300% rate increase

A well-established scaffolding contractor based in the East of England faced a dramatic rate increase following an MBO…

Major scaffolding yard fire - featuring underinsurance and issues with cover - solved

A medium-sized scaffolding contractor faced disastrous consequences when an industrial estate fire spread to their yard and caused fencing, storage bays, ladders, materials and boards to be destroyed…

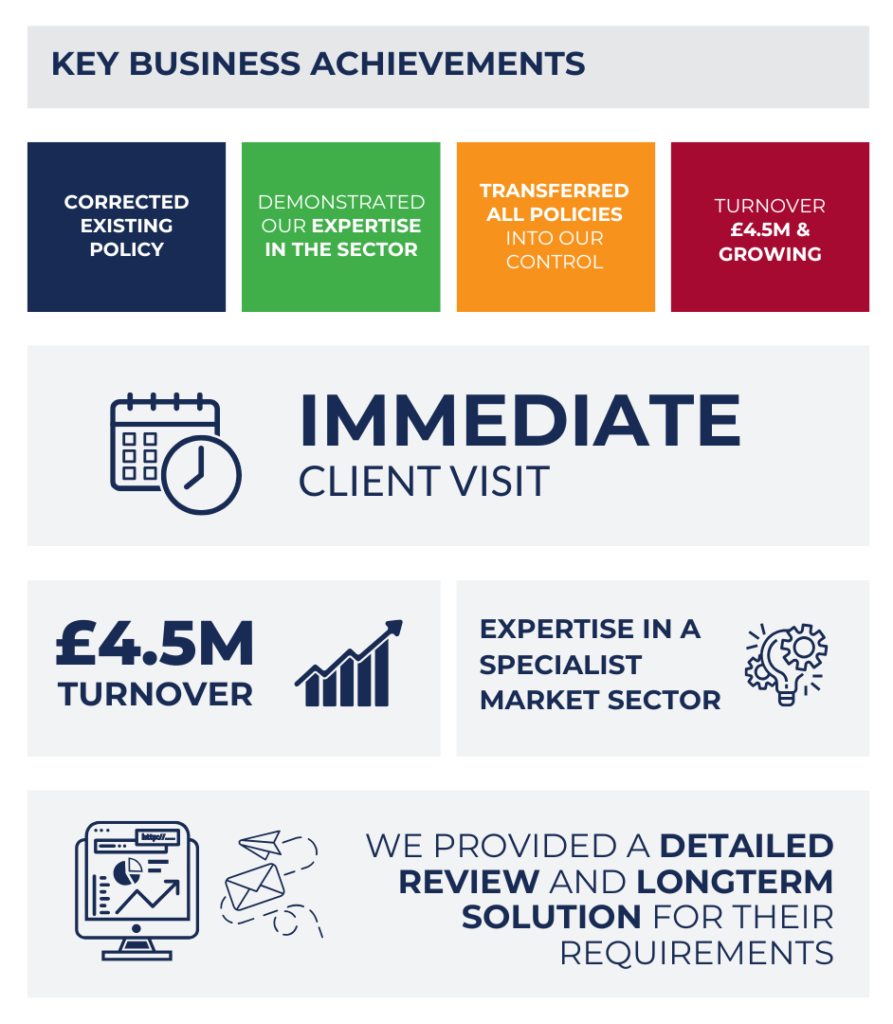

Local underpinning & piling contractor insurance arrangements corrected

A local civil engineering business contacted Ascend to review their insurance arrangements.

Local construction company insurance program corrected with personal advice

A local construction business was recently referred to Ascend Broking by one of our clients, following a review of their insurance policies.

Residents’ association drastically reduces insurance premiums by £67,000

A 90-unit modular block in Central London struggling with rising costs and mismanaged cover

Haulage company requires Ascend to correct their insurance programme to cover new on site HIAB

A rapidly growing haulier who was expanding his business to other activities urgently needed a review of their insurance requirements.

Coachbuilder company grew rapidly by 45% in 12 months

A rapidly growing coachbuilder who was expanding their business proposition to working closely with the local authorities and rental franchises, urgently needed a full coverage review of their insurance requirements

Specialist worldwide marine control & automation systems design & installation requires local service

A leading design, build and testing to marine and land-based sectors required an innovative and local approach to the management of their insurance arrangements…

Specialist marine control & automation systems design & installation requires local service

A leading design, build and testing to marine and land-based sectors required an innovative and local approach to the management of their insurance arrangements.

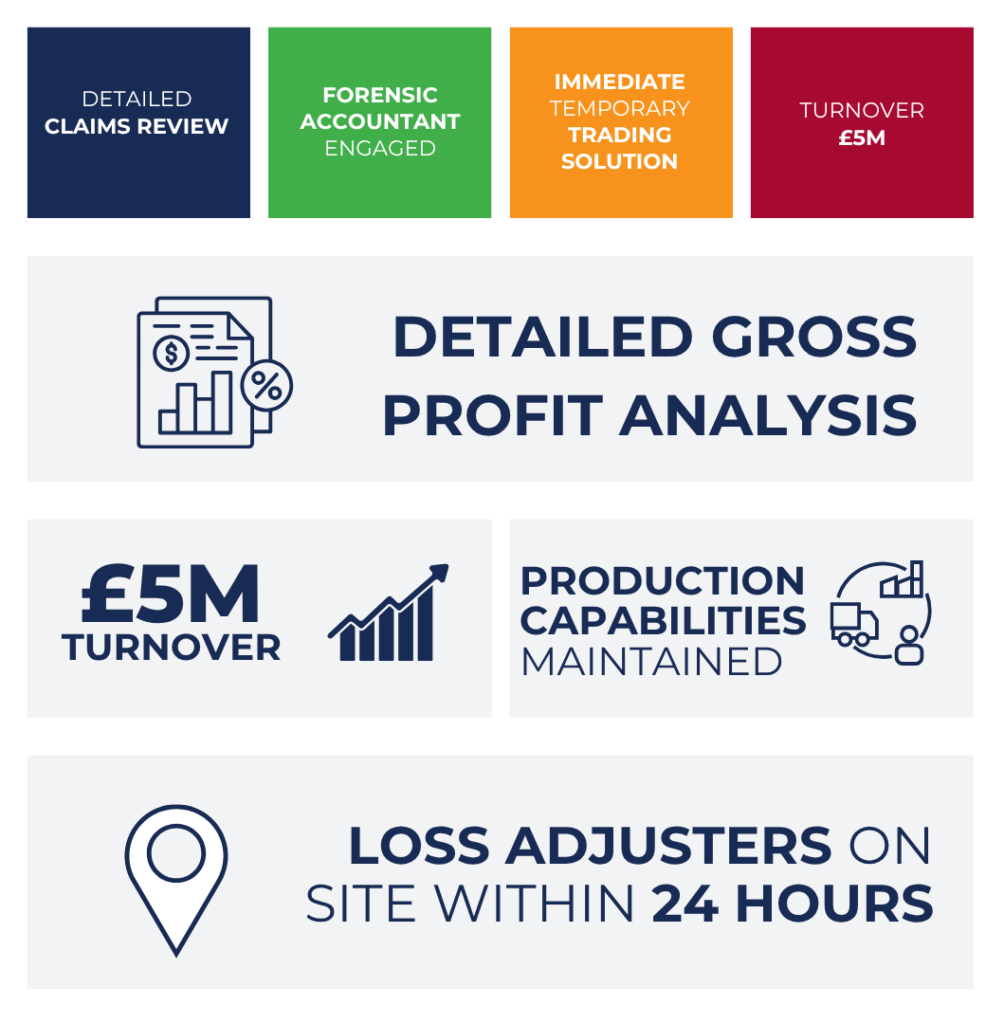

How We Helped a Veneered Wood Panel Manufacturer Stay in Business After a Fire

This case shows the vital role brokers play during complex insurance claims. By understanding the business in depth, we created a tailored plan that helped them stay operational during the disruption.

Wooden packaging manufacturer gains clarity on risk and cover

Hands-on support from Ascend led to premium savings and long-term protection planning

Software consultancy requires Ascend to correct their whole insurance programme

A rapidly growing AI software consultancy business contacted Ascend through our network to urgently review their insurance requirements.

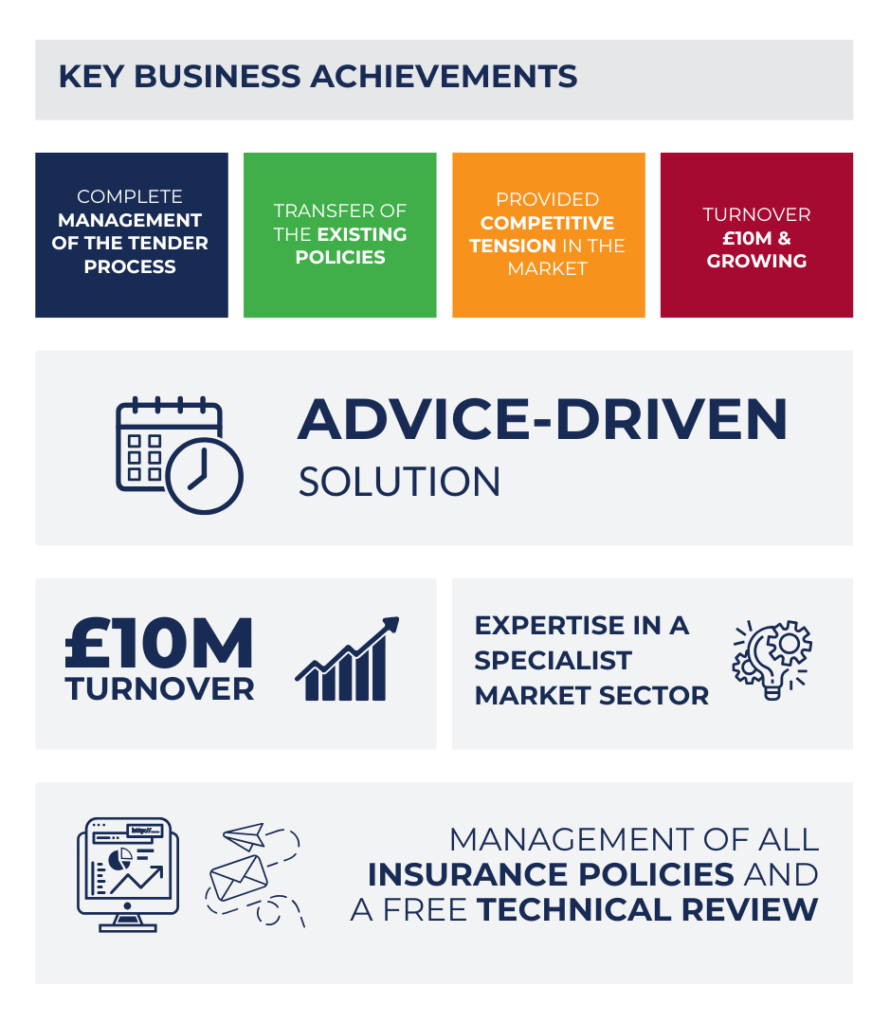

Leading agrochemical consultancy requires a specialist service

A leading advisor to the horticulture sector was referred to Ascend when their existing broker declined to visit and only offered a telephone-based service.

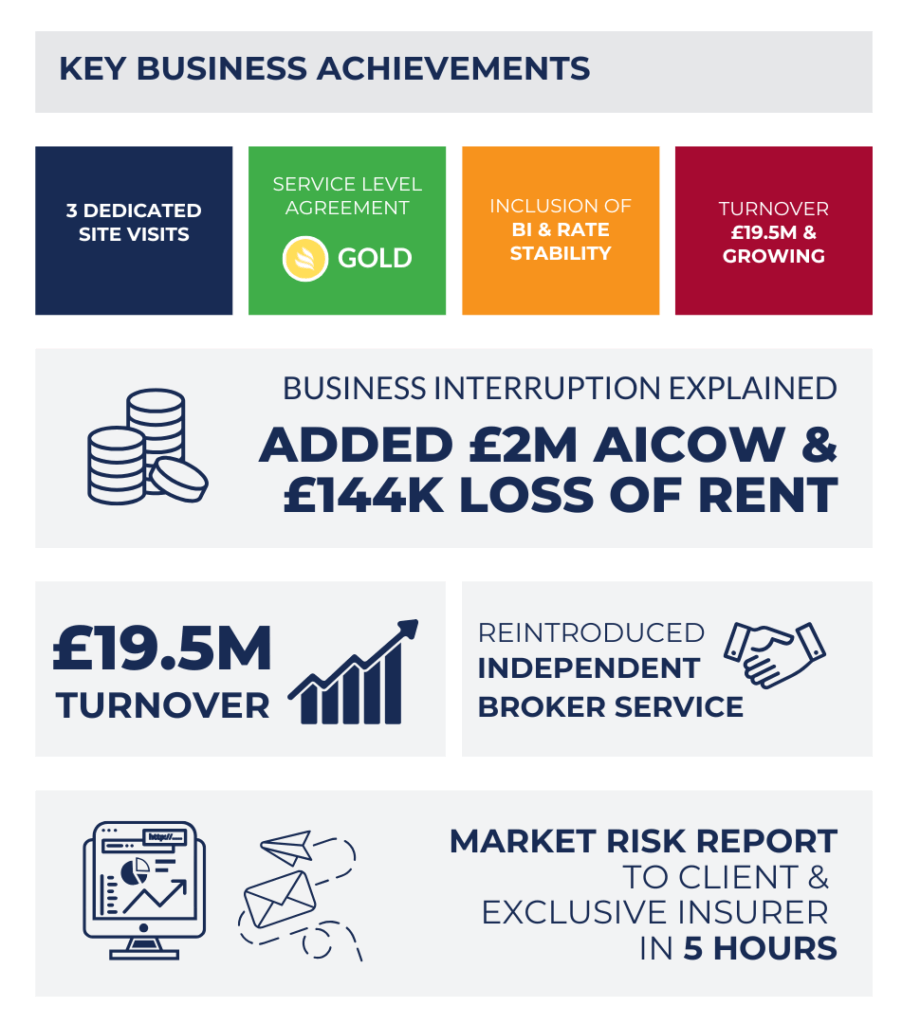

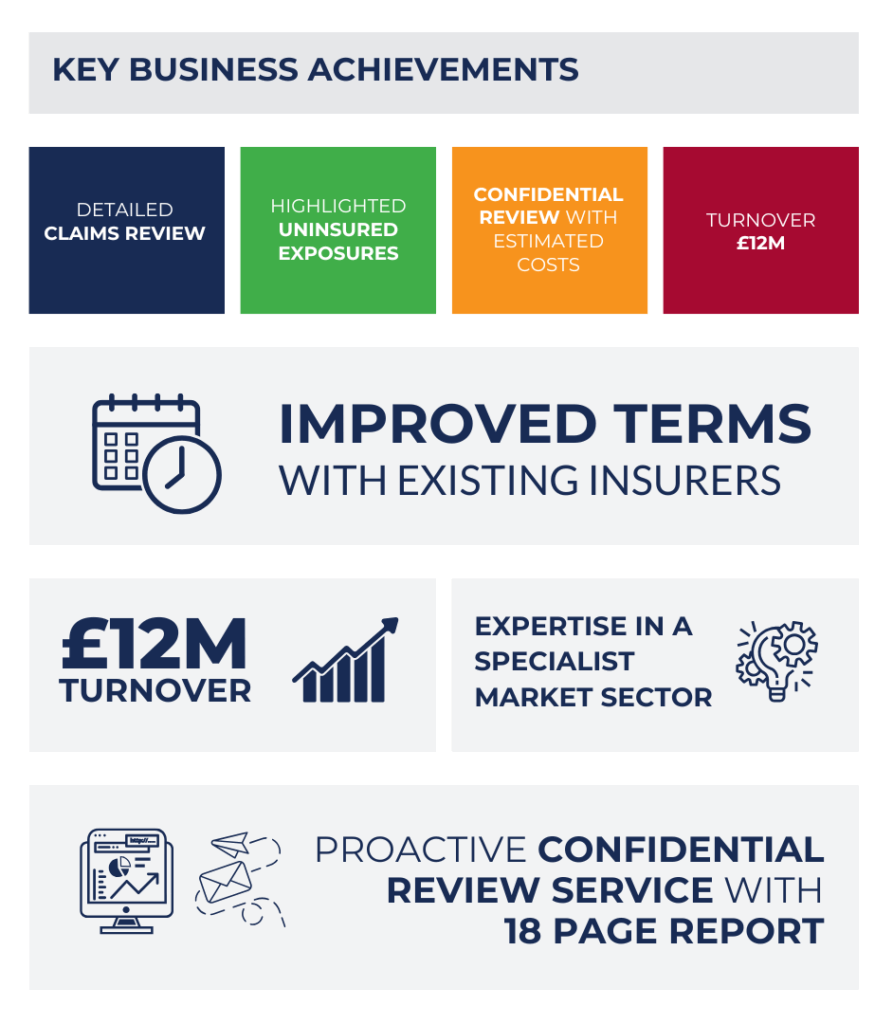

Leading UK leisure & hospitality business appoints Ascend following confidential review

A leading leisure business with venues across the UK appointed Ascend Broking following a confidential review service.