Manufacturer’s Insurance

- Home

- Industry Sectors

- Manufacturer’s Insurance

Manufacturing Insurance

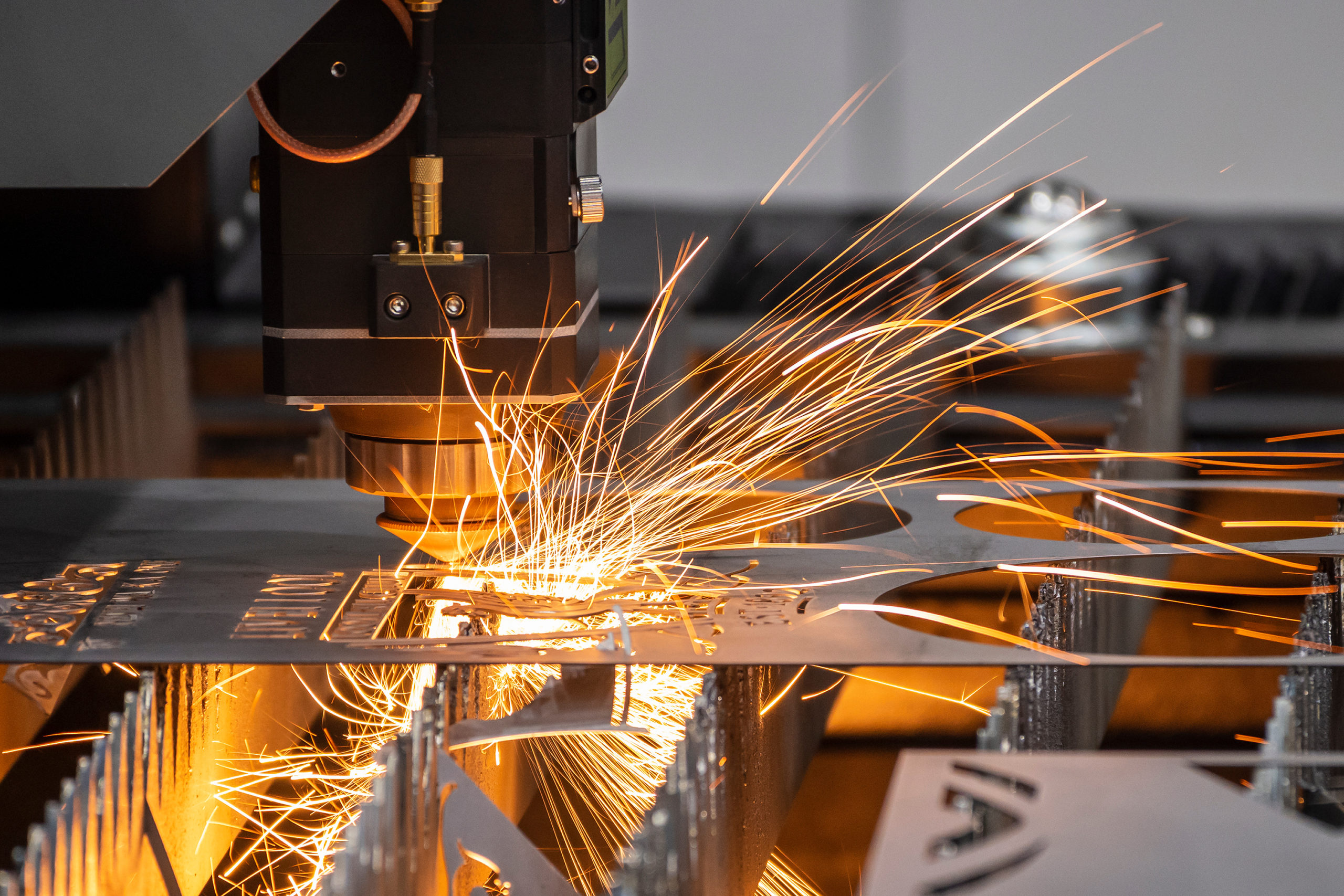

Running a manufacturing business? Then you’ll know it’s not all smooth sailing! Machinery breaks down, supply chains get disrupted, and sometimes, things just don’t go to plan. That’s where manufacturing business insurance comes in. It’s your safety net, covering everything from equipment breakdowns and property damage to product liability insurance and those dreaded business interruptions that can really throw a spanner in the works.

Whether it’s a fire in your factory, a faulty product leading to legal claims or a key machine grinding to a halt, the right cover keeps your business running and compliant with industry regulations. So why risk not having it in place?

Call Ascend Broking Group today for a tailored manufacturing business insurance quote, or email info@ascendbroking.co.uk.

Protect your business, your reputation and your bottom line… before the unexpected happens!

Do you know what Directors and Officers Indemnity Insurance is and why it is so important?

How would you fund the legal costs and awards made against you?

The manufacturer's insurance policies we source can provide cover against a vast range of risks including:

- Employers Liability – For accidents involving your employees

- Public Liability – Damage or injury caused to a third party or their property

- Products Liability – If your products cause injury or illness

- An allegation of wrongdoing or an act of negligence against a director

- Cyber attacks

- Property damage

- Business interruption, including non-damage related options

- Efficacy or failure to perform

Call for a quote

Make an enquiry

What Is Manufacturing Insurance?

Manufacturing insurance is designed to protect businesses involved in production, assembly and distribution from the many risks they face daily. Whether you run a small workshop or a large-scale factory, unexpected events like equipment breakdowns, property damage, product liability claims or business interruptions can seriously impact your operations and finances.

Manufacturing business interruption insurance and manufacturing product liability insurance will safeguard your assets, reputation and future growth. So, if machinery fails, a fire damages your premises or a faulty product leads to legal claims, your business stays protected. Without the right insurance, the costs of repairs, replacements or lawsuits could be devastating.

No matter the size of your operation, manufacturing business insurance is essential for keeping things running smoothly and ensuring long-term financial stability.

What Are The Advantages Of Manufacturing Insurance?

Manufacturing insurance is so important for businesses involved in production, supply chains and distribution. A manufacturing business is at constant risk from issues such as equipment failure, fire, theft and product liability claims – not forgetting the business interruption that can result from any of the above! Any problem or loss that is not covered by manufacturing insurance can lead to significant and devastating financial losses.

Manufacturing insurance protects businesses from unforeseen incidents, ensures compliance with industry regulations and helps maintain stability by covering unexpected disruptions. Tailored policies, finely-tuned to the exact nature of your business, can also provide product recall coverage, employer’s liability and protection against machinery breakdown, offering additional security for manufacturers of all sizes.

Why choose Ascend Broking Group to look after your Manufacturer’s Insurance cover?

Our policies are tailored to meet the needs of this ever-evolving and growing sector, catering for the complex exposures that are faced in the manufacturing and supply chain arenas.

The areas we cover are:

- Safety critical products

- Businesses with import/export exposures

- Manufacturing processes involving hazardous components & materials

- Businesses that are involved in installation and maintenance of products

- Precision engineering

- Multi-site operations with complex supply chain and logistical needs

- Food manufacturing & processing

What do we do other than manufacturer's insurance?

Directors and Officers liability insurance, also known as Directors and Officers indemnity insurance, offers financial protection against any claims for compensation made against directors and officers of a business. Directors and Officers liability cover offers protection if an employee, sub contractor, service recipient or member of the public claims a director or officer has acted wrongfully, and is vital for all businesses.

We go into much greater detail on this on the Directors and Officers insurance page of our website

What services do we offer?

- Friendly and professional service

- Award-winning claims team

- Claims mobile app

- Experts in reducing cost

- 32 years professional experience

- Transparent

- Independent

- Wide insurer panel

- No call centres

- Dedicated contacts

- No office closures

- No policy fees

Who to speak to?

Please contact Chris Buchholz, who is our resident expert for all enquiries regarding manufacturing and precision engineering insurance. Chris has been specialising in Manufacturer’s Insurance for almost 15 years and would be more than happy to discuss your business’ needs. Chris’ contact details can be found below, or if you would prefer, please complete the contact form at the bottom of this page and Chris will contact you at your convenience.

Chris Buchholz Cert CII

Account Executive

M: 07842 021430 E: chris.buchholz@ascendbroking.co.uk

What Is Included In Manufacturing Insurance?

Manufacturing insurance is essential for protecting your business from a range of risks:

Property insurance covers damage to buildings, equipment and stock, ensuring your business can recover from incidents like fire, theft or flooding.

Business interruption insurance helps replace lost income if operations are disrupted due to unforeseen events.

To safeguard against legal claims, product liability insurance covers issues arising from defective products.

Employers’ liability insurance protects against employee injury claims.

Additional coverage options include machinery breakdown insurance, which helps cover repair costs, goods-in-transit insurance to protect stock while being transported, and product recall insurance, providing support if faulty products need to be withdrawn from the market.

A tailored insurance policy ensures financial security and business continuity. To discuss your needs, call Ascend Broking Group today on 01245 449060 or email info@ascendbroking.co.uk.

Property Insurance

Property insurance is a vital part of manufacturing insurance, keeping your business protected when the unexpected happens. Imagine a factory fire damaging expensive machinery or a break-in leading to stolen raw materials? Without the right cover, these losses could be devastating.

This insurance safeguards your buildings, equipment and stock from risks like fire, theft, flooding, vandalism and even natural disasters. It ensures that if disaster strikes, you can recover financially without major setbacks.

Comprehensive property insurance offers broad protection, covering most unforeseen events, except for specific exclusions outlined in the policy.

Business Interruption Insurance

Business interruption insurance is a crucial safety net for manufacturers, protecting against financial losses when operations are disrupted. If a fire forces a factory to shut down for months on end or a major machinery breakdown delays production, the impact on income can be severe.

This coverage helps replace lost revenue caused by events like fire, equipment failure or flooding, ensuring your business can stay afloat even when production halts or supply chains are affected. It provides the financial support needed to recover and maintain stability after unexpected disruptions.

Product Liability Insurance

Product liability insurance is a vital part of manufacturing insurance, protecting businesses from legal claims and financial losses if a product causes harm. If a faulty electrical appliance sparks a fire or a contaminated food product leads to illness, the consequences can be severe – including lawsuits, compensation claims and reputational damage.

This insurance covers legal costs and damages if a product defect results in injury, illness or property damage. It also helps your business comply with industry regulations and safety standards, ensuring financial protection against costly claims and potential recalls.

Employer’s Liability Insurance

Employers’ liability insurance is a crucial part of manufacturing insurance, ensuring businesses meet legal requirements while protecting against costly workplace injury claims. Accidents can happen in factories, warehouses or production lines, despite the best-laid procedures; whether it’s an employee injured by faulty machinery or developing a health condition from prolonged exposure to hazardous materials.

Without the right cover, businesses could face expensive compensation claims and legal fees. Employers’ liability insurance helps cover these costs, providing financial protection while ensuring compliance with workplace safety laws.

Contact Ascend Broking Today

Manufacturing insurance is essential to protect your business from unexpected risks and financial losses. From property damage to legal claims, having the right cover ensures your operations stay secure and compliant.

At Ascend Broking, we are experts at provide tailored manufacturing insurance, including:

- Property insurance: covers damage to buildings, equipment and stock from fire, theft, floods and more.

- Business interruption insurance: protects against lost income if operations are disrupted.

- Product liability insurance: covers legal claims from faulty products causing injury or damage.

- Employers’ liability insurance: a legal requirement covering employee injury or illness claims.

Additional cover: machinery breakdown, goods-in-transit and product recall insurance for extra protection.

With expert advice and bespoke policies, Ascend Broking ensures you have the right cover for every risk. Get started today: call 01245 449060, email info@ascendbroking.co.uk, or visit www.ascendbroking.co.uk. And let’s protect your business together!