Fire & Security Insurance

- Home

- Industry Sectors

- Fire & Security Insurance

- Efficacy cover, known as failure to perform by a product or service

- Protects your liability for injury to third parties, or damage to third party property

- Turnover split between activities

- MOT Loss of Licence

- Defective Workshop Service Indemnity

Breach of duty in negligence liability may be found to exist where you fail to meet the standard of care required by law.

- Negligence

- Infringement of intellectual property rights

- Breach of confidence

- Corporate liability

- Directors & officers

- Employment practices

- Profits

- Commissions & training costs

- Civil authority ingress & egress

- Data breaches

- Cyber crimes

- 1st & 3rd party cover

- All risks cover

- Portable hand-held tools

- Overnight tools cover

- Any driver restrictions

- Mini fleet through to self-insurance

- Risk management options

Ascend will assist you in risk managing the remaining elements of your business to tailor the policy to your requirements. These can include but are not limited to:

- Buildings (Or Tenants’ Improvements)

- Stock (Vehicle, Parts & Accessories)

- Demonstration Cover (Accompanied / Un-Accompanied)

- Courtesy/Loan Vehicles

- Public Liability

- Engineering Inspection & Breakdown

- Business Interruption

,At Ascend, we have our dedicated experts who are able to provide solutions from start-ups through to multi-site locations, and can even arrange self-insurance programmes for the larger operator.

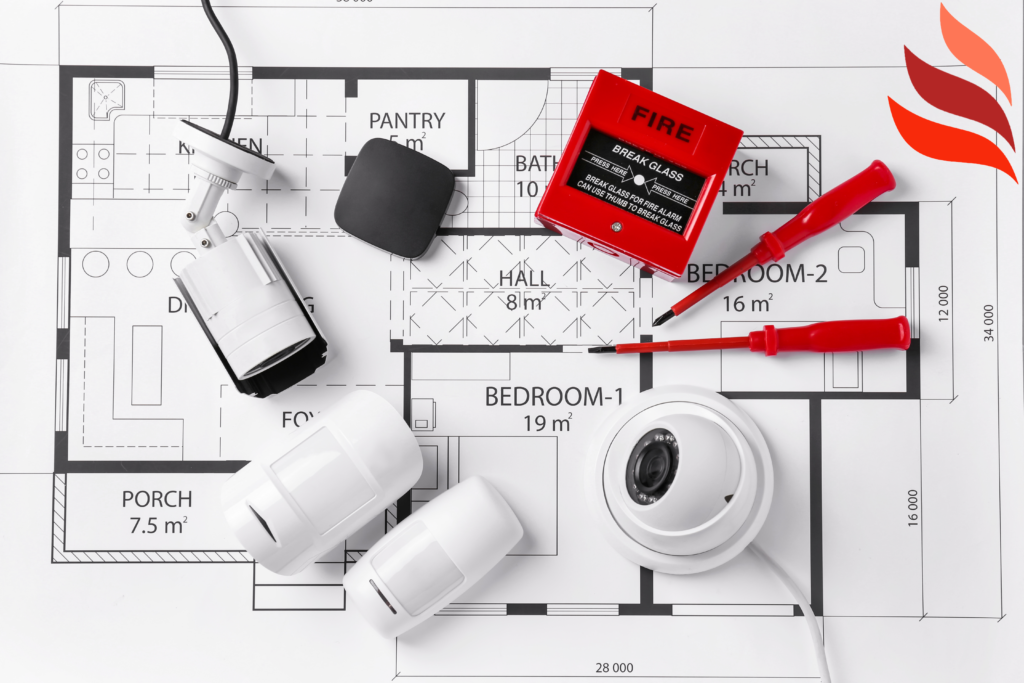

We appreciate the challenges the fire & security industry faces, from national firms to sole traders. With this in mind, we have bespoke fire & security insurance tailored to your trade activities, and we assist in building a policy to your specific cover requirements from a panel of our A rated insurers. We will highlight any differences in cover between insurers and ensure you are confident in your own insurance cover.

- Support against all regulators

- Regulatory investigations

- Regulatory prosecutions

- Breaches of contract

- Fees for intervention

- Employment tribunal and ACAS claims

- Defence for the organisation itself

- £100,000 data protection breach

- Customer/supplier contact cover

- Employee theft cover

- Deprivation of assets

- Employment civil fines

- Pollution clean-up cost cover

- Third party electronic funds transfer cover

- Loss of directors’ time

- Brand damage

- Employee engagement impact

- 24/7 out-of-hours crisis line

- Stress and worry mitigation for directors & managers

- Defence against employment tribunal claims

- £25,000 pursuit cover for contract disputes and debt recovery

- Legal defence for directors, trusteees, partners and officers

- Negative social media crisis and public relations costs

- Circumstance investigation/mitigation costs

- 24 hours, 7 days a week crisis line straight to a solicitor at no additional cost

- Legal advice line Mon-Fri 8am-6pm

- Legally privileged advice, support & representation

- Downloadable legal & regulatory advice, support guides, letters & templates

- Access to our digital tools via exclusive portal

Why you need Fire & Security Insurance

There are legal requirements in the United Kingdom to have certain insurance policies in place in the Fire & Security sector, with two fundamental elements of cover you need to be aware of.

- Business Interruption

Business interruption insurance is insurance coverage that replaces business income lost in a disaster. The event could be, for example, a fire or a natural disaster. - Employers Liability

This is also a legal requirement if you have at least one employee, and does include many types of sub-contractor, too. If you are caught without cover, you can be fined up to £2,500 per employee, per day.

Stuart Belbin Cert CII

Please contact Stuart Belbin, who heads our charity division, for all charity enquiries. Stuart has been specialising in EPL Insurance for a number of years and would be more than happy to discuss your needs. Stuart’s contact details can be found below or, if you would prefer, please complete the contact form at the bottom of this page and Stuart will contact you at your convenience.

Account Executive

M: 07736956221 E: stuart.belbin@ascendbroking.co.uk