Case Study

- Home

- Case Study

Case Study

Coachbuilder company grew rapidly by 45% in 12 months

A business trading for 20+ years based in Essex with a national distribution network

A rapidly growing coachbuilder who was expanding their business proposition to working closely with the local authorities and rental franchises, urgently needed a full coverage review of their insurance requirements. The core covers in place were satisfactory motor trade insurance and ancillary products, however at the omission they felt like they were being upsold to rather than truly understanding the policy trigger points and where/how claims arose in those areas. A full review was completed over 3 site visits and a clear plan of action was established on visit one in terms of market placement.

Following the discovery call, it was established early that the service levels of the existing broker were slipping following a corporate acquisition, the client was very conscious of a large premium increase due to their rapid growth, they wanted to get the old school motor trade broker feel back and it was apparent that business interruption was not ever truly explained in full.

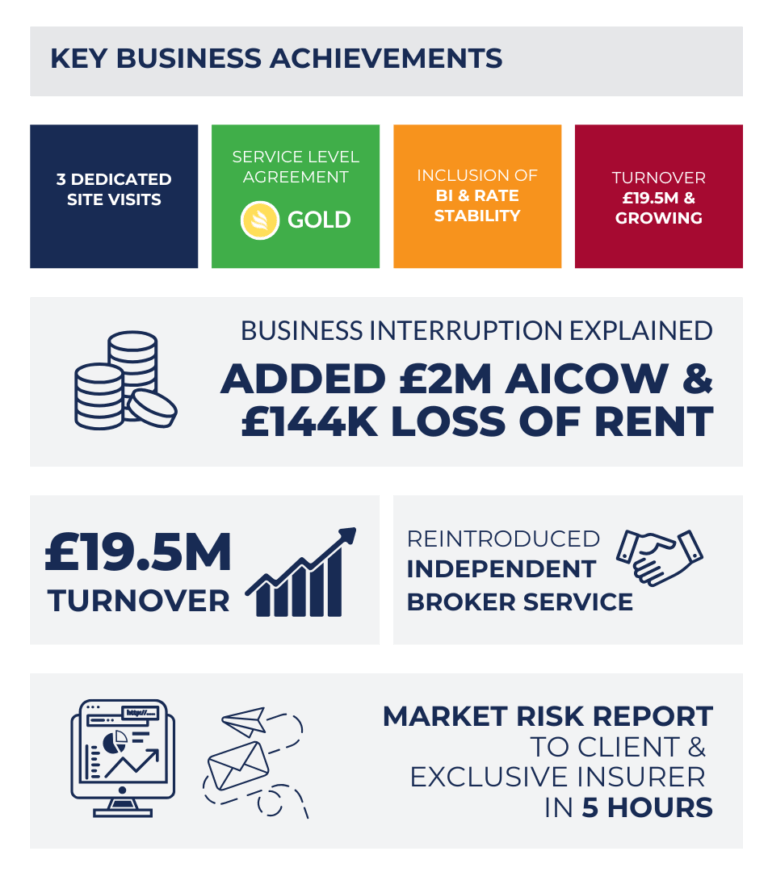

Key Business Achievements

The Problem

Following a successful year of partnerships, the client suddenly faced the unknown of what would happen with the insurance premium and if cover was still adequate following the rapid growth. A mutual connection reached out and advised of the concerns that the coachbuilder was having following the corporate buyout of their once personable brokerage, a referral to Steve Gillespie was made to tender as the first attacking broker in 15 years!

After an initial appointment setting telephone call, Steve was on-site the next morning for a full-fact find and discussed the market approach and solution – all part of the pre-meeting preparation that Steve had concluded, so the client could see a full solution was available through one exclusive insurer.

We discovered:

▶ The company needed tailored advice and guidance through these exciting times

▶ Business Interruption cover/options were not explained in full

▶ Multiple companies interlinked – identified land liability was missing

▶ No future proofing protections on their premiums either through escalator clauses or long term agreements

The Solution

Ascend had set out objectives with one exclusive insurer and timelines when information and terms would be presented to the client – all based on the correct covers and discussed with client to understand the business activities and then prepared an in-depth underwriting information for discussion with specialist insurers in the client’s sector. The previous broker had marketed the company to every market as a reaction to our first meeting with no clear relationship with one underwriter.

The process was as follows:

▶ Immediate response and terms obtained on correct activities.

▶A full presentation and summary of what we are providing

▶ Bespoke advice on limits/terms and conditions

▶ Conclusion of an all-inclusive package we used our expertise and to assist the insured during this difficult time.

▶ We corrected coverage as follows and current broker did not address these within their renewal report: –

- +2% Index Linking

- Added in Rent Payable in Business Interruption

- Increased Gross Profit by £1million per annual

- Implemented a 3 year rate stability clause

- Introduced land liability

- Added £2M Increased Cost of Working Business Interruption

- Turnover from 13.5M to 19.5M

Ascend now administers all of the client’s insurance programme through letter of appointment.