Case Study

- Home

- Case Study

Case Study

How We Helped a Veneered Wood Panel Manufacturer Stay in Business After a Fire

This case highlights the critical role that brokers play in helping businesses navigate complex insurance claims. By spending time with the business to fully understand their operations and the potential risks, we were able to tailor a comprehensive plan that ensured they could continue trading through the disruption. The flexible tools available under the policy, such as ‘Increased Costs of Working’, and the expertise of a forensic accountant to address the loss of profit, were key to mitigating the impact of the fire.

For manufacturing businesses, especially those relying on highly specialised equipment, it’s essential to work closely with your broker to understand the full range of coverage options. Taking the time to plan for these worst-case scenarios can protect your livelihood and ensure you can continue business operations even when things go wrong.

In the end, with swift action and the right coverage, the manufacturer was able to stay in business and recover from the fire’s impact, proving the value of adequate insurance and expert guidance during a crisis.

Key Business Achievements

The Problem

A leading veneered wood panel manufacturer experienced a major disruption when a fire broke out in their external extraction hopper. The fire was caused by a spark that had travelled from a machine to the hopper, igniting the materials and blowing out the factory windows. While the immediate damage was contained to a few pallets of stock, the true impact of the incident came when the fire rendered the extraction equipment inoperable.

Without the extraction system functioning, the factory’s machinery was rendered useless. Production came to a complete halt, putting the business at risk of significant financial losses. The manufacturer was now faced with the challenge of maintaining operations and protecting their workforce while the damage was being assessed and repaired.

The Solution

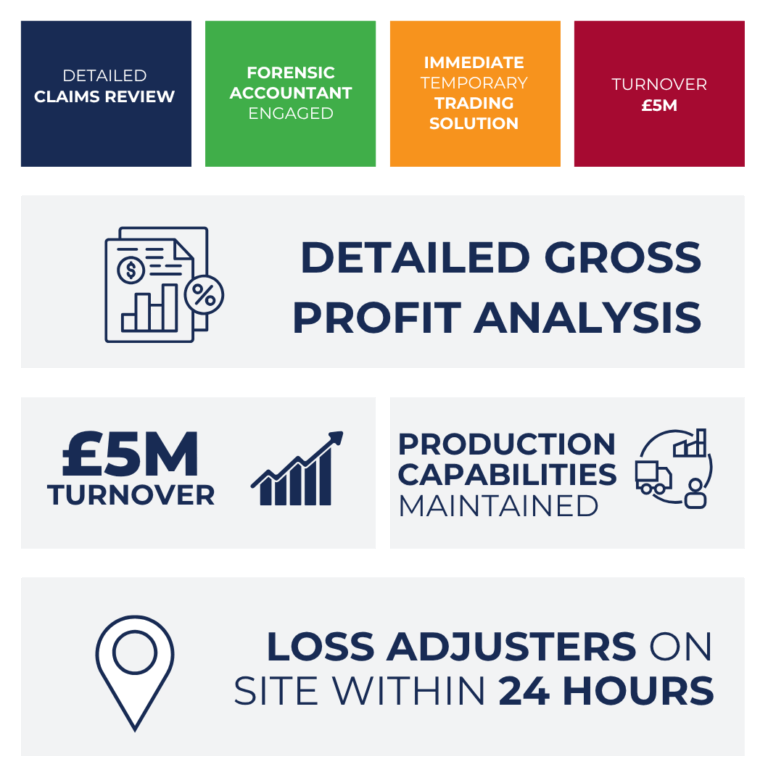

The day after the fire, we visited the site alongside the loss adjusters to assess the damage and formulate a plan for getting the factory back up and running. Our first priority was to ensure that the business could continue production at a reduced capacity. We quickly identified that the factory needed a temporary solution to replace the inoperable extraction units.

To enable continued production, we arranged for five portable extraction units to be delivered and moved around the factory as needed. These units allowed the business to run at about 50% capacity, ensuring that some production could continue while the necessary repairs were underway. In addition, we approved overtime pay for staff to make up for lost time and ensure that the operation could maximise output during this period.

These extra costs were covered under the ‘Increased Costs of Working’ section of the business’s insurance policy, demonstrating the importance of having comprehensive coverage to support businesses during such disruptions.

The next step: addressing gross profit loss

Once the extraction system was reinstated, the next challenge was quantifying the business’s loss of gross profit. We worked closely with the manufacturer and engaged a forensic accountant to review the company’s financial history. By analysing turnover trends and forecasting expected earnings based on historical data, the accountant was able to provide a clear estimate of the loss.

This detailed report helped us ensure that the business was compensated for the full extent of their financial loss, covering not only the direct costs but also the lost revenue due to the fire’s impact on production.