Case Study

- Home

- Case Study

Case Study

Wooden packaging manufacturer gains clarity on risk and cover

A growing wooden packing manufacturer and freight forwarder with a £1 million turnover had never once seen their broker on site. They were operating with multiple cover types but lacked coordinated advice on how to manage risk across the business. Based in the UK and recommended to Ascend by their accountant, the client welcomed the opportunity to work with a broker who would proactively review their operation and recommend tangible improvements.

Within weeks, Ascend had arranged a site visit, conducted a full walkthrough of the facility, and introduced trusted health and safety partners to strengthen the business’s risk management procedures.

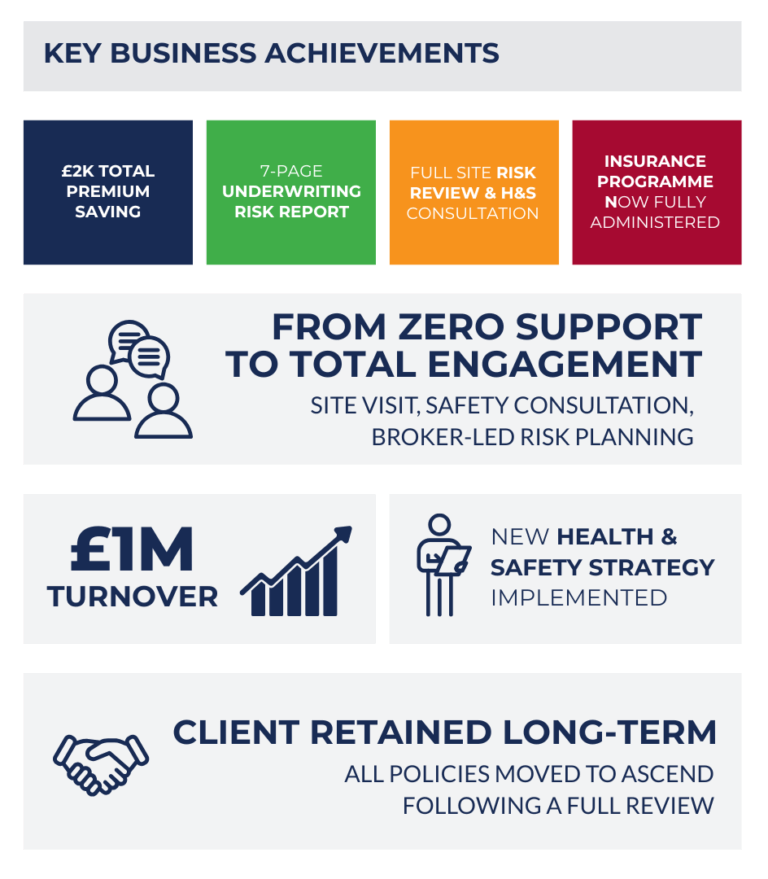

Key Business Achievements

The Problem

Despite the company’s clear exposure across transport, handling, and freight activities, their insurance programme was treated as a tick-box exercise. The business had:

▶ Never met their appointed broker

▶ No written risk management plan or insurer feedback

▶ Limited understanding of what cover they had or needed

▶No access to supporting services such as safety consultants or surveys

Their accountant, concerned by the lack of strategic insurance support, introduced them to Ascend.

The Solution

Ascend arranged an on-site visit to walk through every part of the operation, from loading areas to admin zones. This was followed by a tailored discussion with underwriters and health and safety professionals to identify potential exposures and reduce the likelihood of future claims.

Our process included:

▶ A full site risk assessment

▶ Broker-led survey conducted with insurer

▶ Introduction to a dedicated health & safety adviser

▶ Full review of policy limits, extensions, and risk controls

▶ A comprehensive 7-page underwriting report delivered to the insurer

The result was a reduction in premium by £2,000 and a newfound sense of understanding and control over their insurance programme.