15 November 2024

Rising Home Insurance Premiums in the High Net Worth Market

It’s no secret that home insurance premiums are rising almost daily, and this is undoubtedly true for the high net worth home market, too. High net worth homeowners are seeing rates quickly increasing due to various factors including inflation and uncertainty in the global economy, as well as a rise in claims costs, rebuild costs and fraudulent claims. In addition, there is reduced capacity in the market following recent exits or consolidation of insurers.

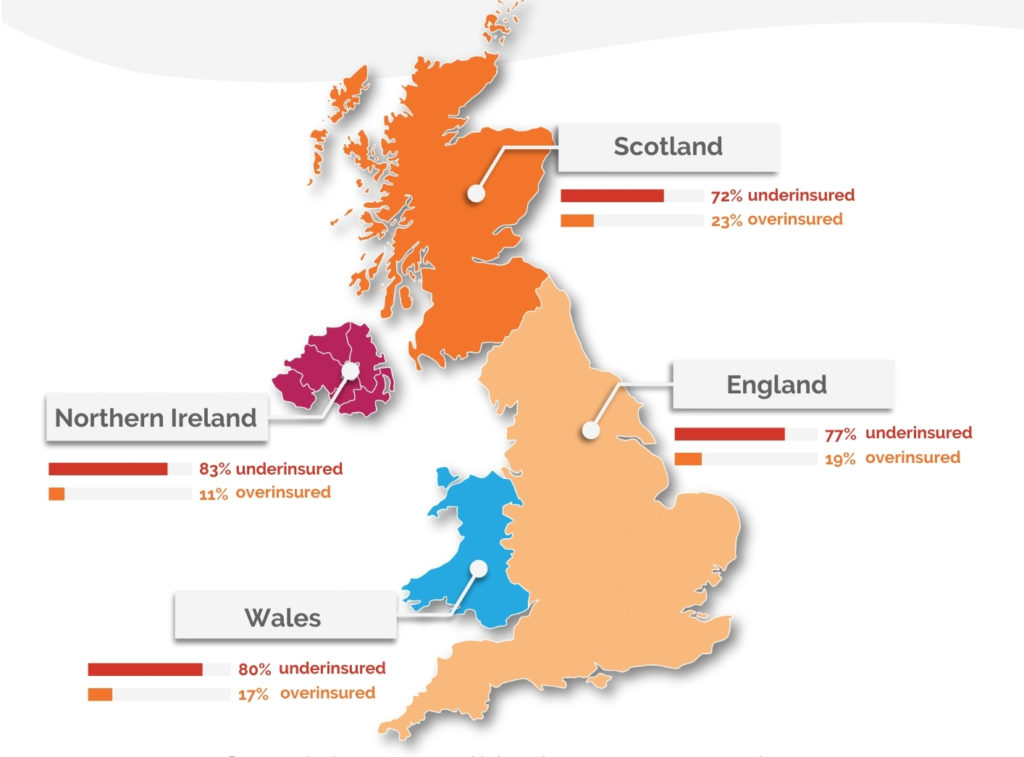

According to RebuildCostAssessment's latest statistics, 76% of UK buildings are underinsured. The graphic above highlights these staggering statistics, showcasing that many policyholders may need to review their level of insurance.

How are HNW clients underinsured?

Rising claims costs are leading to underwriting tightening and premium pressure

The cost of an average home insurance policy has increased by 25% over the last 12 months.The impact on carriers affects consumers, too

Homes in higher-risk areas can even see increases up to 50% or more, and we anticipate further rate increases into 2025 and beyond. So, how can you balance your costs with adequate coverage amid all this uncertainty? One of the best strategies is leveraging the expertise of a specialist insurance advisor.Underinsurance is more of an issue for high net worth clients than ever before, new research finds

Underinsurance is now a pressing concern with 40% of high net worth (HNW) clients being underinsured, 4% higher compared to data in 2023 provided by Ecclesiastical. The survey also revealed that buildings (66%), jewellery (62%), contents (59%), and watches (53%) are the areas in which clients are most underinsured.- Out-of-date valuations (76%)

- Lack of awareness of the value of their property and possessions (74%)

- Lack of awareness of the rise in rebuild and repair costs (71%)

- Not reviewing and keeping up-to-date sums insured (70%)

Consolidation in the HNW insurance market has seen AXA XL and Azur both being acquired, and other insurers have ceased to be active in the sector

Mergers & acquisitions of high net worth focused businesses has created ‘one of the hardest markets’ for placing these specialist risks. Consolidation of the likes of AXA XL and Azur by Aviva, plus a number of significant market exits – such as Nationwide, Covéa and AIG, last year – have led to a restriction in the capacity available in the market.Insurance review: your next step in addressing rising rates

Consider scheduling a meeting with your independent insurance advisor to map out the best course of action to navigate the current insurance market. A comprehensive insurance review can address the cost and placement challenges consumers are experiencing today, ensuring you have appropriate coverage and assistance in structuring a long-term insurance plan. Here are some recommendations high net worth individuals and families can immediately consider while reviewing their insurance programme:- Report claims with caution: Your insurance programme should be structured to protect against catastrophic events. Now, more than ever, families should be cautious when reporting small claims to their home insurance provider.

- Consider high excess levels: Too often, we see homeowners with £250 excess. Excesses are the quickest way to manage annual premium spend – consider £1,000 or £2,000 as standard.

- Don’t overuse windscreen glass cover: Clients reporting frequent glass chip repair or windshield replacements could have trouble finding new insurance should they shop the market:

- Insurer underwriters are heavily scrutinising these small claims and will decline to offer coverage to clients with a history of small claims.

- Additionally, many carriers have built-in rating algorithms that do not “surcharge” for glass claims (as they advertise); however, they place your policy in a worse rating tier if you have too many, resulting in a higher premium.

- Insure your home to value: What would it cost to rebuild your home in 2024 or 2025? When did you last have a RICS rebuild assessment?

- The replacement cost often exceeds the market value, especially for homes that are over 20 years old.

- Protect your home against future losses: Speak to your insurance advisor about risk prevention devices and strategies that reduce your risk of a future claim. Insurance carriers provide substantial discounts for clients who invest to lower their risk profile. These include centrally monitored fire & burglar alarms, automatic water shut-off devices, electrical surge detectors and back-up generators.

- Verify insurable interest: Ensure that any Trust or other entities with insurable interest are appropriately listed on your home, auto and umbrella policies.

- Protect valuables: Make sure that your jewellery, artwork, sculptures, coins, stamps, wine, whiskey or musical instruments have been professionally valued for a replacement cost within the last two years.

- Account for rising inflation: The cost-of-living crisis and limited supply have meant the value of luxury high-end watches, including Rolex and Patek Philippe, have continued to soar. Some clients may not realise their current values and, if the worst was to happen and they needed to purchase a replacement, they may find themselves significantly underinsured. Ecclesiastical advises that HNW clients should review their sums insured annually to ensure their possessions are insured correctly. Fast-appreciating items including jewellery and watches should be revalued every three years and those with more stable values, including fine art, porcelain and antiques, every five years.

- Speak with Ascend Executive: We are an advisor who specialises in protecting affluent families and has access to the full market of affluent insurance providers.

Other blogs which may be of interest:

Mourning rings - Reviving tradition in modern jewellery trends Dazzling trends designer jewellery in 2024There’s no time like the present, and our team is here to help – get in touch with Matthew.Collins@ascendbroking.co.uk or Amy.English@ascendbroking.co.uk to navigate the intricacies of the insurance market. The Ascend team is here to answer your questions and offer a strategic roadmap for your insurance needs.

Recent Posts

Ascend Broking

ASCEND BROKING GROUP LAUNCHES ASCEND RISK

Ascend Broking