24 March 2025

Why must you have cyber insurance?

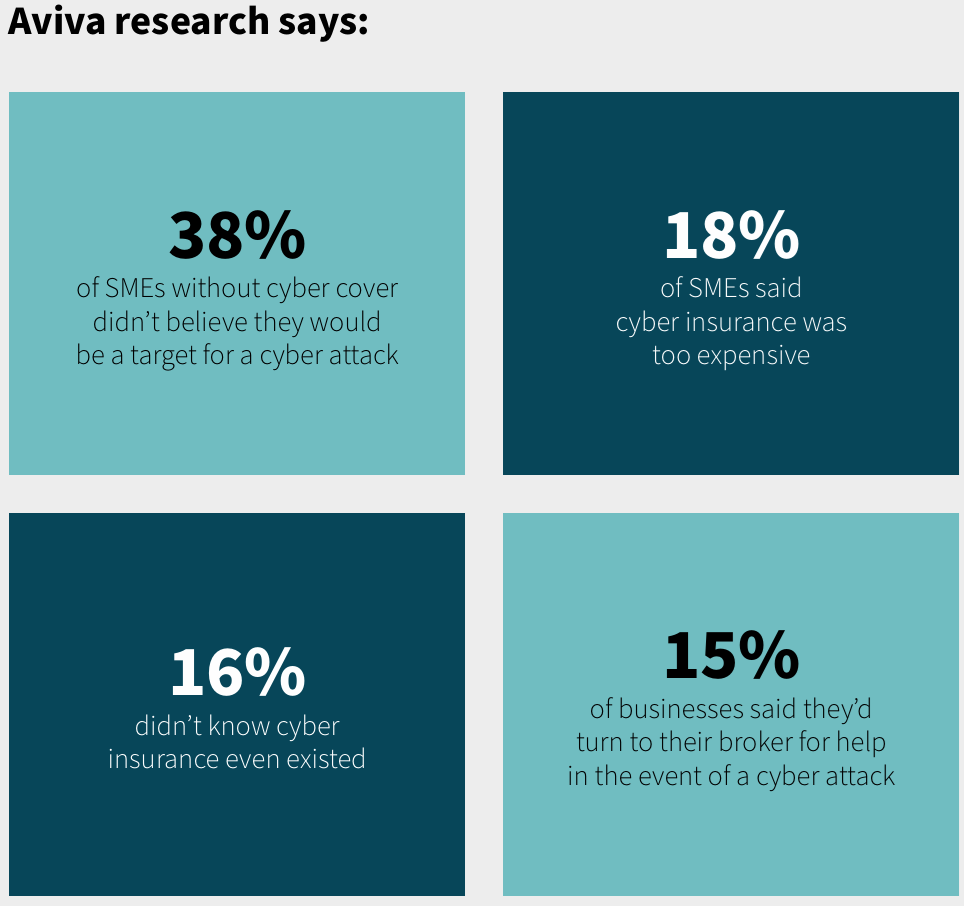

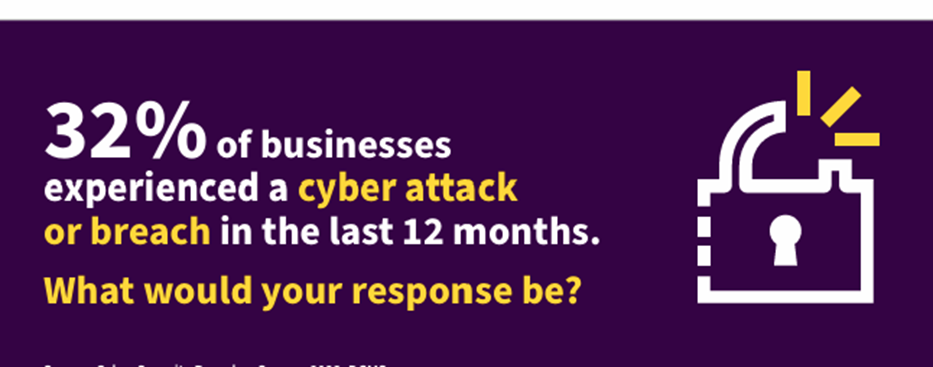

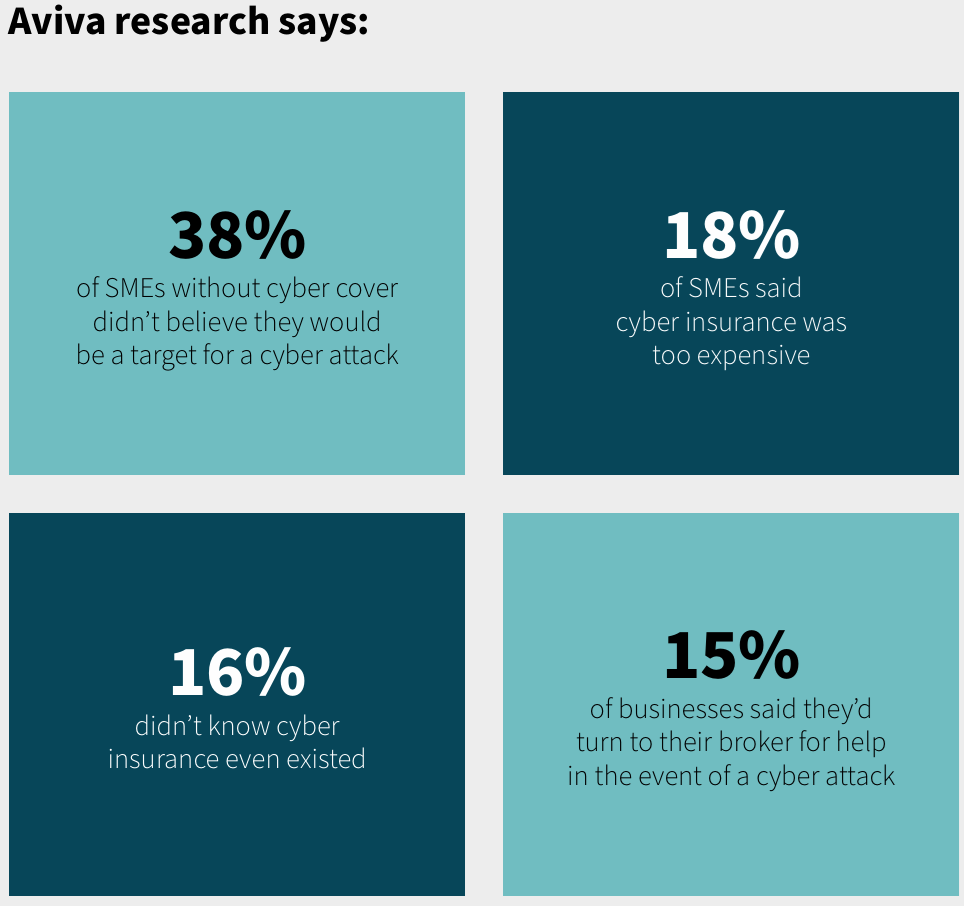

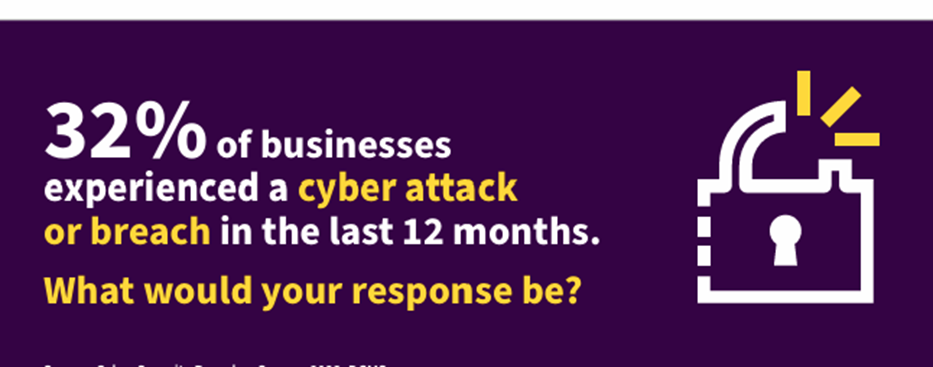

Research has shown 71% of businesses see cyber risk as a high priority – yet 50% still don’t have adequate cover in place. We can provide simple, affordable protection that helps you continue to trade, adapt or evolve with confidence.

Visit our dedicate cyber insurance resource centre

To find out more about our cyber insurance products, visit https://ascendbroking.co.uk/insurance/cyber-data-insurance or feel free to contact Matthew Collins matthew.collins@ascendbroking.co.uk.

Visit our dedicate cyber insurance resource centre

To find out more about our cyber insurance products, visit https://ascendbroking.co.uk/insurance/cyber-data-insurance or feel free to contact Matthew Collins matthew.collins@ascendbroking.co.uk.

- All businesses are at risk

- People make mistakes

- Time is of the essence

- Operations & reputations need protecting

- Third parties need reassurance

- Regulations are always evolving

Visit our dedicate cyber insurance resource centre

To find out more about our cyber insurance products, visit https://ascendbroking.co.uk/insurance/cyber-data-insurance or feel free to contact Matthew Collins matthew.collins@ascendbroking.co.uk.

Visit our dedicate cyber insurance resource centre

To find out more about our cyber insurance products, visit https://ascendbroking.co.uk/insurance/cyber-data-insurance or feel free to contact Matthew Collins matthew.collins@ascendbroking.co.uk.

Recent Posts

Ascend Broking

ASCEND BROKING GROUP LAUNCHES ASCEND RISK

Ascend Broking