8 August 2024

The Importance of Equipment Breakdown Insurance

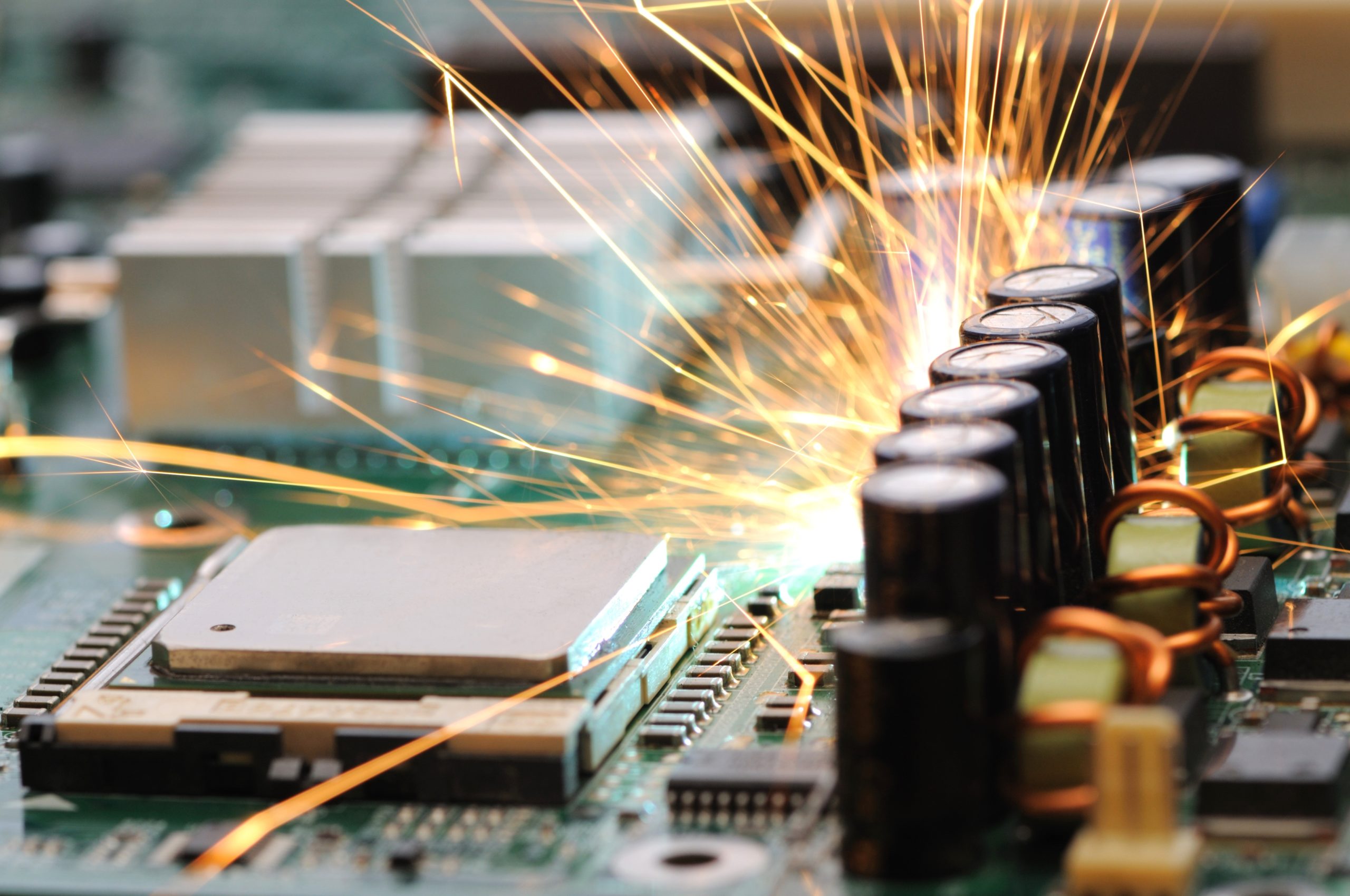

Today’s machinery and equipment is more high-tech and specialised than ever, but, as the backbone that keeps operations running smoothly, it can also be more unpredictable as technology advances. Whilst machinery has evolved, from manufacturing plants and data centres to small businesses and healthcare facilities, so too have the risks should something go wrong.

What happens when these essential pieces of equipment break down unexpectedly? How much will your business suffer if this integral part of your day-to-day activity malfunctions? The impact on it can be devastating, leading to frustrating operational downtime, painful financial losses and unavoidable reputational damage. This is where equipment breakdown insurance becomes crucial, so let’s explore the true cost of equipment failure and five key benefits of making sure you have equipment breakdown insurance firmly in place.

Understanding equipment breakdown insurance

Equipment breakdown insurance, sometimes referred to as boiler and machinery insurance, provides coverage for the sudden and accidental breakdown of equipment. This can include a wide range of machinery, from HVAC systems and refrigeration units to electrical equipment and computer servers. Unlike traditional property insurance, which typically covers external risks like fire or theft, equipment breakdown insurance focuses on the internal mechanisms and operational aspects of machinery – vital for the smooth, day-to-day running of your business.The key benefits of equipment breakdown insurance

-

Financial protection

-

Minimising operational downtime

-

Coverage for a wide range of equipment

- HVAC systems

- Refrigeration units

- Electrical equipment

- Computers and servers

-

Protection against hidden risks

-

Supporting business continuity

Case studies

Case study 1:

A small bakery relies heavily on its ovens and refrigeration units. One summer’s morning, both its main oven and its huge, refrigerated pantry break down unexpectedly, causing a huge headache for the worried bakers and the owner on site. The bakery faces immediate challenges in meeting customer orders and has to make the regrettable decision to close for the rest of the day. But all is not lost, as the bakery has equipment breakdown insurance in place. An engineer is summoned immediately who fixes both the oven and the fridges and, subsequently, a claim goes into the insurance company. The policy covers the cost of repairing the pantry refrigeration system, and replacing the faulty oven, as well as all lost income from the downtime when the bakery had to be closed. The stressful morning at the bakery therefore has no lasting repercussions for the business. It suffers no financial loss from the equipment failure and temporary closure because of equipment breakdown insurance.Case study 2:

An automotive parts manufacturing company in the North of England with 150 employees operates advanced machinery including CNC machines, hydraulic presses and robotic assembly lines. One day in winter, the business experiences a sudden and unexpected breakdown of one of their key CNC machines - responsible for producing intricate components - leading to an immediate halt in a significant portion of the production line and causing delays in fulfilling client orders. The cost of repairing the CNC machine is estimated to be around £40,000, with at least two weeks downtime, and the company faces potential penalty fees for late deliveries to clients. Fortunately, the business has invested in equipment breakdown insurance, which covers the repair costs, the loss in business income and the additional costs associated with expedited shipping of necessary parts and labour, reducing the repair time from two weeks to ten days. The insurance also covers the cost of renting a temporary CNC machine, allowing the company to continue production and meet client deadlines as closely as possible. Having equipment breakdown insurance is a crucial component of a company’s risk management strategy. It provides a safety net for unforeseen incidents that can otherwise lead to severe financial and operational repercussions. Insurance coverage for equipment breakdown ensures that businesses can maintain continuity even in the face of significant disruptions. This helps protect not only the company's revenue but also its reputation and client relationships. Investing in comprehensive insurance policies is a proactive step that businesses can take to safeguard against potential equipment failures and the associated downtime and costs. Don't wait for a breakdown to realise the value of this coverage—take proactive steps to protect your business today!Other blogs which may be of interest:

Product recall insurance Employment tribunals: What every business needs to knowWant to find out more? Contact Ascend today on 01245 449060 or email the team on info@ascendbroking.co.uk.

Recent Posts

Ascend Broking

ASCEND BROKING GROUP LAUNCHES ASCEND RISK

Ascend Broking