7 December 2023

Ten Fun Facts on the History of Insurance

Yes, insurance can be fun!! Each month Ascend will bring you some insurance fun facts you may not be aware of, starting with the history of insurance. Have you ever wondered how it all began? Here are 10 fun facts of history of insurance!

So, there we have it! Ten fun facts about the history of insurance. Join us next month for some more insurance nuggets that may surprise you!

- Joseph, interpreting Pharaoh’s prophetic dream in the Old Testament, devised a food insurance fund to prepare for an anticipated famine, establishing the idea of planning for disaster.

- In early human societies, including Babylonia (around 1760 BC) and Ancient Greece and Rome, mutual insurance emerged as a form of collective mutual assistance. In Rome, collegium members paid monthly fees, and the fund provided a specified amount for funerals, with strict criteria for eligibility.

- Chinese traders in the 3rd and 2nd millennia BC practiced risk management by distributing their goods across multiple vessels. This strategy reduced the risk of total loss in the event of a shipwreck or other sea voyage mishaps.

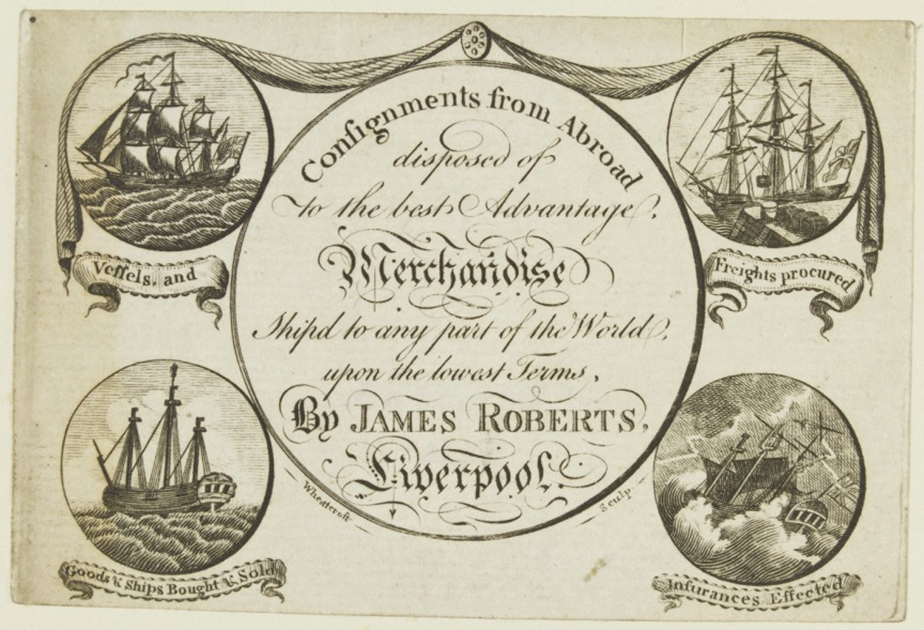

- In 1347, Genoa, Italy, saw the issuance of the first recorded marine insurance policy. This policy covered risks associated with sea voyages, marking the start of modern insurance practices.

- The first ‘Insurance Chamber’ was established in Bruges, Belgium, in 1310, protecting artisans and merchants' financial interests against looting or robbery during the Middle Ages.

- England became the birthplace of life insurance. In 1699, a professional organization focusing on life insurance for widows and orphans emerged. Later, the Equitable Life Assurance Society became the first company to offer personal insurance to citizens.

- The Travelers Insurance Company sold the first car insurance policy in the US in 1898. Mr. Martin insured his car for $500, paying $12.25. The Travelers Insurance Company, a pioneer in the industry, still operates today.

- The Great Fire of London in 1666 led Nicholas Barbon to establish the first fire insurance company. He founded the Fire Office in 1680, offering insurance against fire-related damages in London. Sir Christopher Wren included a site for ‘the Insurance Office’ in his plans for rebuilding London after the disaster.

- Lloyd's of London began in 1688 as a coffeehouse opened by Edward Lloyd near the London docks. It became a gathering place for merchants and shipowners to discuss events and insure vessels. Edward started the ‘Lloyd’s List’, a daily journal of information, leading to the creation of modern insurance contracts and the term ‘underwriter’.

- The 19th century saw the rise of factory mutuals, insurance cooperatives formed by industrial firms to share the risks of fire and other hazards. These cooperatives laid the foundation for modern industrial insurance. FM Global, a London-based company, traces its roots back to these early factory mutuals and continues to focus on engineering-based risk management solutions for industrial clients.

Any questions? Please don’t hesitate to contact one of our team.

Matthew.collins@ascendbroking.co.uk| Telephone: 01245 449 060

Tags:Ascend Broking Group

Recent Posts

Ascend Broking

How AI is Revolutionising Fleet Safety

Ascend Broking

The Risks of Leaving Tools in Vehicles Overnight

Ascend Broking