6 March 2017

Cyber Insurance and why it is a necessity

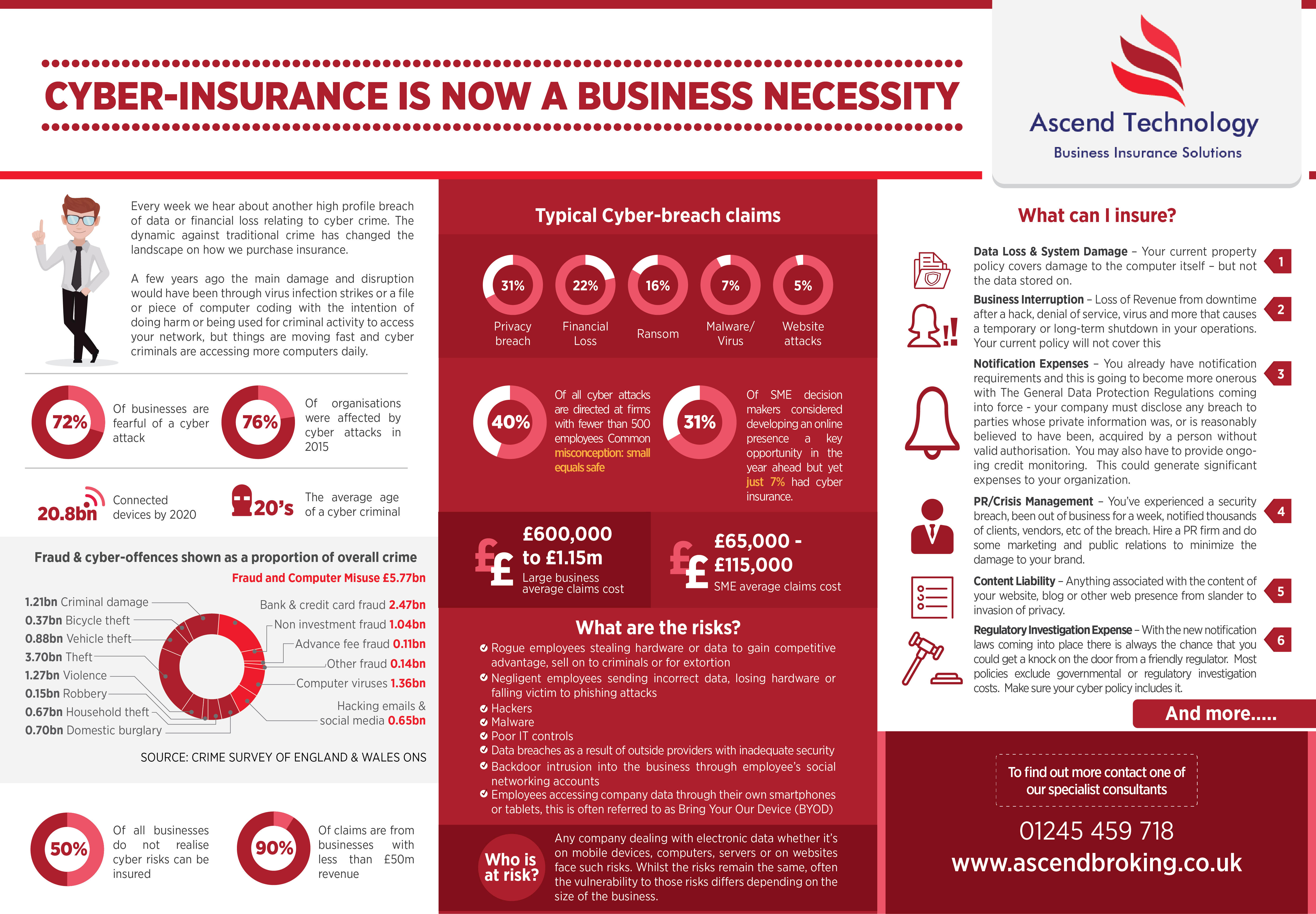

[caption id="attachment_1466" align="alignnone" width="300"] Why you need cyber insurance[/caption]

Every business owner knows that you need to have insurance against fire even though the chances of your premises burning down in a given year are very low. But many business owners operate without cyber insurance although up to 76% of businesses are hacked every year with the average claims cost of £100,000. It is a common misconception that cyber crime only affects big businesses, but the truth is smaller businesses are being increasingly targeted by cyber criminals.

Almost every business is vulnerable to cyber-crime yet only 7% of businesses insure against this. Your website being forced offline choking your ability to trade, your internal computer system could be hacked, locked down and held ransom or personal details of your customers could be stolen putting you inline for penalties or reputational damage.

When a cyber attack does happen, cyber insurance is the best way to ensure your business is not harmed in the long run. Cyber insurance can pay for forensic investigators, crisis managers and public relations professions. It can cover new computer hardware and even ransom payments. It can cover any liability your company faces over a data breach as well as legal costs. It can also pay for extensive costs of notifying all your customers when there is a data breach and more and of course the significant business interruption you will face.

We make understanding your exposures and putting together appropriate insurance protection for your business a simple process. Please take time to look at our cyber crime fact sheet where we explain a little more about this increasing important insurance risk.

We aim to make the process of understanding your exposure and putting together an appropriate policy an easy one for our customers. Policies start from £250 - why not contact us now to discuss in more detail or obtain a quote?

.http://https://www.youtube.com/watch?v=PtO7dn8rbUQ&t=4s

[playlist type="video" ids="1458"]

Why you need cyber insurance[/caption]

Every business owner knows that you need to have insurance against fire even though the chances of your premises burning down in a given year are very low. But many business owners operate without cyber insurance although up to 76% of businesses are hacked every year with the average claims cost of £100,000. It is a common misconception that cyber crime only affects big businesses, but the truth is smaller businesses are being increasingly targeted by cyber criminals.

Almost every business is vulnerable to cyber-crime yet only 7% of businesses insure against this. Your website being forced offline choking your ability to trade, your internal computer system could be hacked, locked down and held ransom or personal details of your customers could be stolen putting you inline for penalties or reputational damage.

When a cyber attack does happen, cyber insurance is the best way to ensure your business is not harmed in the long run. Cyber insurance can pay for forensic investigators, crisis managers and public relations professions. It can cover new computer hardware and even ransom payments. It can cover any liability your company faces over a data breach as well as legal costs. It can also pay for extensive costs of notifying all your customers when there is a data breach and more and of course the significant business interruption you will face.

We make understanding your exposures and putting together appropriate insurance protection for your business a simple process. Please take time to look at our cyber crime fact sheet where we explain a little more about this increasing important insurance risk.

We aim to make the process of understanding your exposure and putting together an appropriate policy an easy one for our customers. Policies start from £250 - why not contact us now to discuss in more detail or obtain a quote?

.http://https://www.youtube.com/watch?v=PtO7dn8rbUQ&t=4s

[playlist type="video" ids="1458"]

Why you need cyber insurance[/caption]

Every business owner knows that you need to have insurance against fire even though the chances of your premises burning down in a given year are very low. But many business owners operate without cyber insurance although up to 76% of businesses are hacked every year with the average claims cost of £100,000. It is a common misconception that cyber crime only affects big businesses, but the truth is smaller businesses are being increasingly targeted by cyber criminals.

Almost every business is vulnerable to cyber-crime yet only 7% of businesses insure against this. Your website being forced offline choking your ability to trade, your internal computer system could be hacked, locked down and held ransom or personal details of your customers could be stolen putting you inline for penalties or reputational damage.

When a cyber attack does happen, cyber insurance is the best way to ensure your business is not harmed in the long run. Cyber insurance can pay for forensic investigators, crisis managers and public relations professions. It can cover new computer hardware and even ransom payments. It can cover any liability your company faces over a data breach as well as legal costs. It can also pay for extensive costs of notifying all your customers when there is a data breach and more and of course the significant business interruption you will face.

We make understanding your exposures and putting together appropriate insurance protection for your business a simple process. Please take time to look at our cyber crime fact sheet where we explain a little more about this increasing important insurance risk.

We aim to make the process of understanding your exposure and putting together an appropriate policy an easy one for our customers. Policies start from £250 - why not contact us now to discuss in more detail or obtain a quote?

.http://https://www.youtube.com/watch?v=PtO7dn8rbUQ&t=4s

[playlist type="video" ids="1458"]

Why you need cyber insurance[/caption]

Every business owner knows that you need to have insurance against fire even though the chances of your premises burning down in a given year are very low. But many business owners operate without cyber insurance although up to 76% of businesses are hacked every year with the average claims cost of £100,000. It is a common misconception that cyber crime only affects big businesses, but the truth is smaller businesses are being increasingly targeted by cyber criminals.

Almost every business is vulnerable to cyber-crime yet only 7% of businesses insure against this. Your website being forced offline choking your ability to trade, your internal computer system could be hacked, locked down and held ransom or personal details of your customers could be stolen putting you inline for penalties or reputational damage.

When a cyber attack does happen, cyber insurance is the best way to ensure your business is not harmed in the long run. Cyber insurance can pay for forensic investigators, crisis managers and public relations professions. It can cover new computer hardware and even ransom payments. It can cover any liability your company faces over a data breach as well as legal costs. It can also pay for extensive costs of notifying all your customers when there is a data breach and more and of course the significant business interruption you will face.

We make understanding your exposures and putting together appropriate insurance protection for your business a simple process. Please take time to look at our cyber crime fact sheet where we explain a little more about this increasing important insurance risk.

We aim to make the process of understanding your exposure and putting together an appropriate policy an easy one for our customers. Policies start from £250 - why not contact us now to discuss in more detail or obtain a quote?

.http://https://www.youtube.com/watch?v=PtO7dn8rbUQ&t=4s

[playlist type="video" ids="1458"]

Recent Posts

Ascend Broking

ASCEND BROKING GROUP LAUNCHES ASCEND RISK

Ascend Broking