8 August 2024

The Importance of Equipment Breakdown Insurance

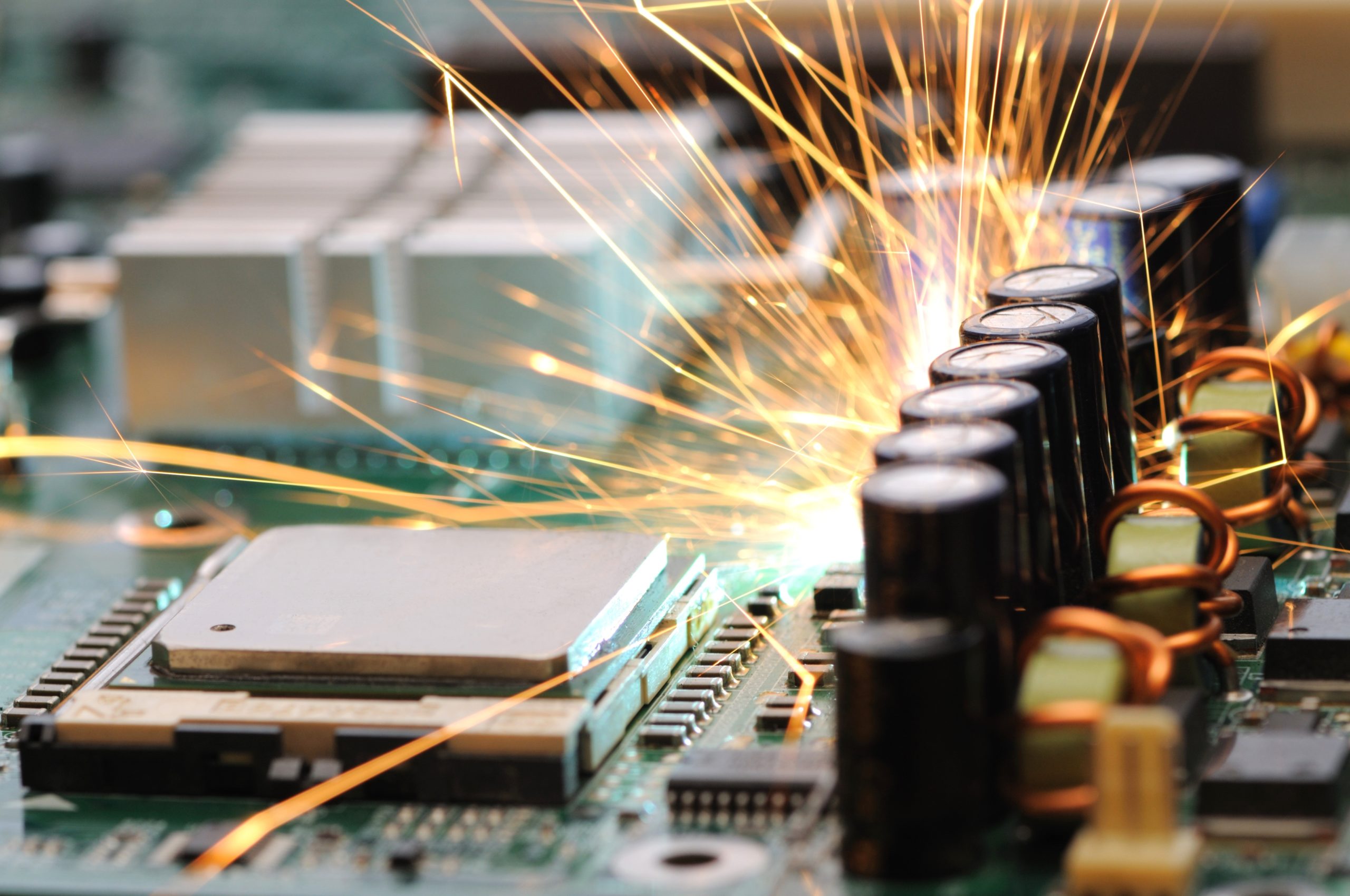

Today’s machinery and equipment is more high-tech and specialised than ever, but, as the backbone that keeps operations running smoothly, it can also be more unpredictable as technology advances. Whilst machinery has evolved, from manufacturing plants and data centres to small businesses and healthcare facilities, so too have the risks should something go wrong.

What happens when these essential pieces of equipment break down unexpectedly? How much will your business suffer if this integral part of your day-to-day activity malfunctions? The impact on it can be devastating, leading to frustrating operational downtime, painful financial losses and unavoidable reputational damage. This is where equipment breakdown insurance becomes crucial, so let’s explore the true cost of equipment failure and five key benefits of making sure you have equipment breakdown insurance firmly in place.

Understanding equipment breakdown insurance

Equipment breakdown insurance, sometimes referred to as boiler and machinery insurance, provides coverage for the sudden and accidental breakdown of equipment. This can include a wide range of machinery, from HVAC systems and refrigeration units to electrical equipment and computer servers. Unlike traditional property insurance, which typically covers external risks like fire or theft, equipment breakdown insurance focuses on the internal mechanisms and operational aspects of machinery – vital for the smooth, day-to-day running of your business.The key benefits of equipment breakdown insurance

-

Financial protection

-

Minimising operational downtime

-

Coverage for a wide range of equipment

- HVAC systems

- Refrigeration units

- Electrical equipment

- Computers and servers

-

Protection against hidden risks

-

Supporting business continuity